Automate supply chain finance

There are four main pain points for finance teams running supply chain finance programs.

Prima’s proven SCF technology can address these pain points, which typically limit the scope and efficiency of SCF programs. Our plaform can go live without an initial IT project so is easy to pilot - and can wrap-around existing SCF platforms and programs so that these can just be made bigger and more efficient.

Automate supply chain finance programs and remove manual processes; scale SCF programs to the enterprise level no matter how many subsidiaries, accounting systems (ERPs) and procurement teams are involved.

Supply chain finance - what is it?

Supply chain finance programs provide a way for selected suppliers to get an accelerated payment based on the credit standing of the large corporate buyer at the top of the supply chain.

This can be done either using excess liquidity of the large corporate (“dynamic discounting”) or by introducing funders who provide trade finance to the suppliers upfront whilst allowing the large corporate buyer to pay later (called “payables finance”, “trade finance”, "supply chain finance" or “SCF”).

What are the manual processes in SCF programs?

Most supply chain finance programs are quite manual for the finance teams involved at the large corporate buyer.

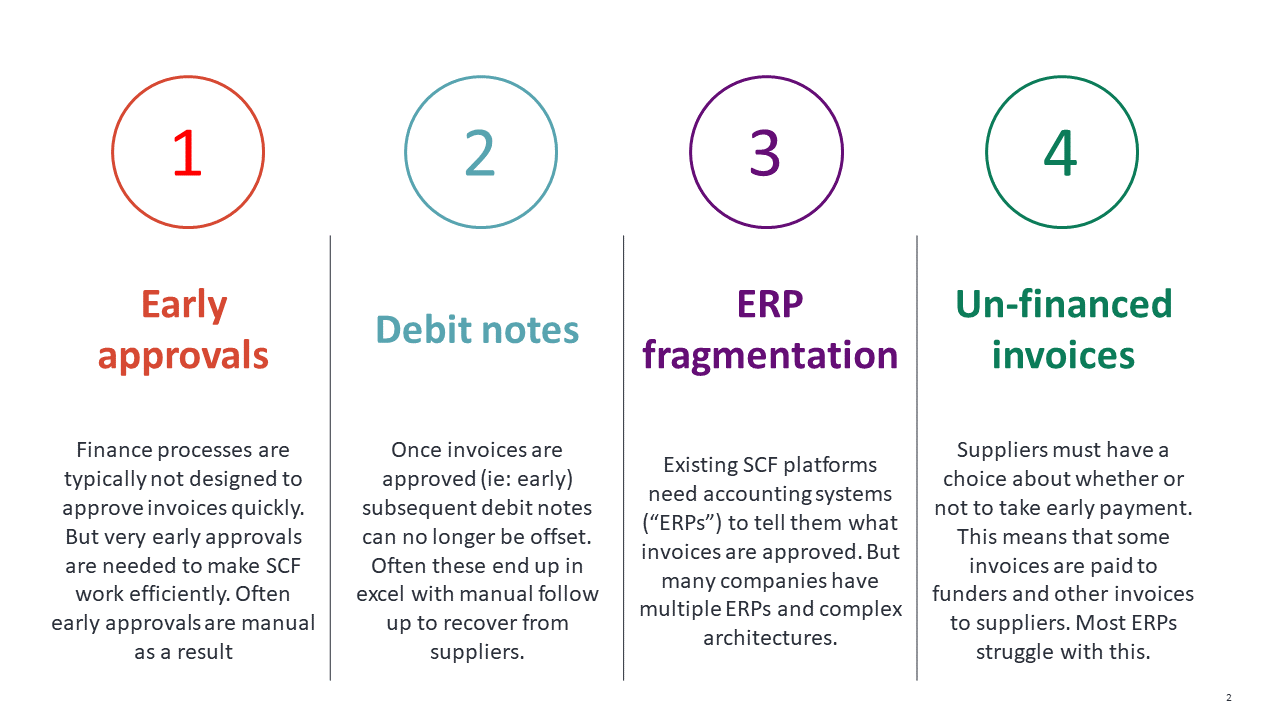

SCF four points of pain

There are four main manual processes:

Early approvals: In order for suppliers to get their invoices paid early, finance teams need to approve them. But most invoice approval processes are slow and only work after delivery and various internal checks. They can take 30, 40, 50 days or more to operate. Speeding this up so that suppliers can get accelerated payments means upsetting this accounting and control process – and implementing special arrangements that are often “human-powered”. And if invoices cannot be approved early enough, suppliers are not helped via the SCF program.

Debit notes: If invoices are approved and suppliers receive their cash early, finance teams lose the ability to offset debit notes that they raise to deal with quality, delivery and other typical product issues. If the supplier has already been paid in full then debit note set off is no longer available. This means that recovering claims against suppliers has to move off-system (typically to Excel with a manual follow-up to individual suppliers).

ERP fragmentation: Many large corporates have multiple accounting systems, subsidiaries and finance teams in different geographies. Traditional SCF (without Prima) requires each of these individual finance teams and each individual ERP system to be re-organised for SCF in order to deliver early invoice approvals and to handle debit notes (as above). Often companies only do this for their major operations as a result – leaving large parts of their activities out of scope as a result.

Un-financed invoices: Under accounting rules, suppliers must be given the choice as to whether the invoices that they issue should be accelerated for payment or not. This means that some supplier invoices may be accelerated and need to be paid to a funder, whilst other invoices for the same supplier may not be accelerated and so need to be paid to the supplier. Most corporate accounting systems do not cope with this situation leading to manual reconciliations and complexities to keep track of what is going on and organise payments accurately.

How does Prima solve finance team pain in SCF?

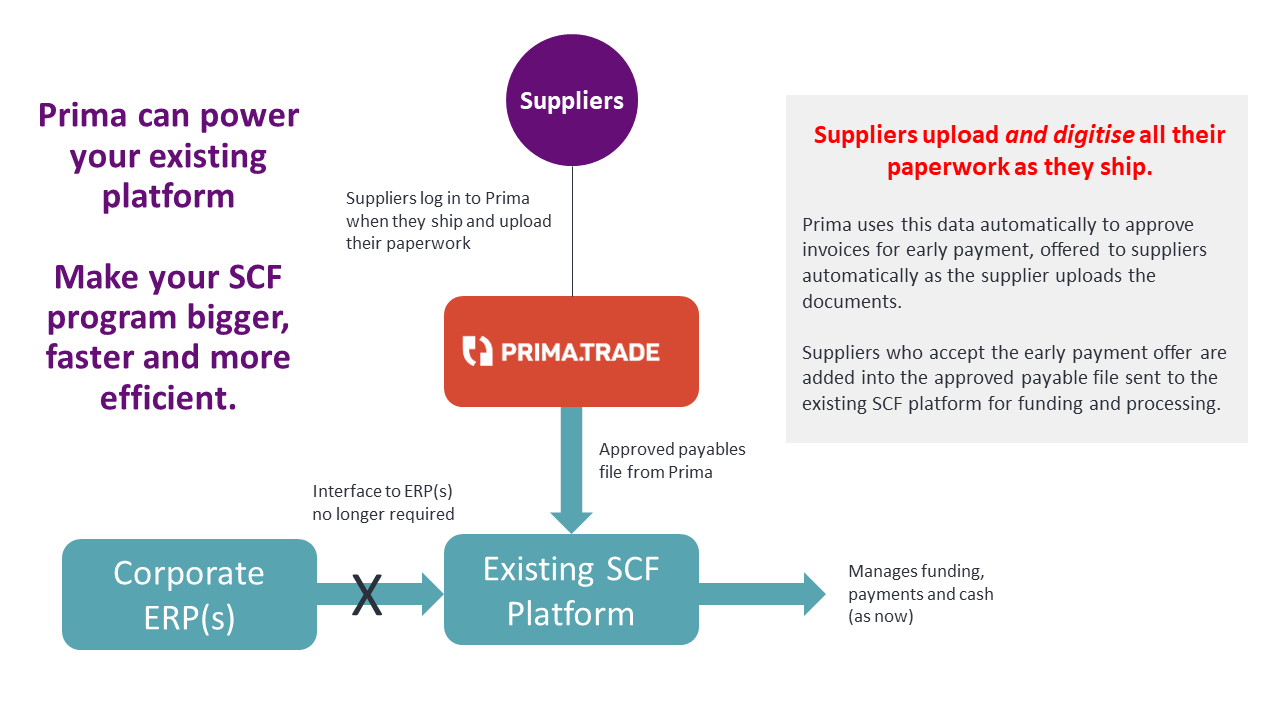

Prima’s platform is self-contained and can either (a) run the whole supply chain finance program entirely or (b) automatically drive an existing platform (like Prime Revenue, Taulia, Demica etc).

In both cases, there is no mandatory requirement for an interface to the accounting system because Prima’s system runs on supplier data.

Each time a supplier ships, the supplier uploads and self-digitizes all their paperwork – such as transport documents, packing lists and invoices. This is much more data than is typically available in the corporate ERP and it is data that is available much earlier (ie: at shipment).

Moreover, as an option, suppliers can also match their documents to purchase orders on the Prima platform so that buyers can be confident that suppliers are delivering what has been ordered.

All this data allows Prima to automate the early approval using built-in rules. The existing manual early approval process can become automatic. Prima solves the early approval pain.

This early approval can either be used directly with funders on the Prima platform or it can be provided as an “approved payables” file to an existing SCF platform (run by a bank or a vendor platform like Taulia, Prime Revenue etc).

Prima can feed existing SCF platforms

Prima's ability to feed existing SCF platforms means that your existing programs can be made bigger, faster and more efficient without re-organising the relationship with your funders.

Moreover, the Prima platform allows early approvals to be partial, ie: less than 100%. This leaves a buffer to manage risk for the corporate buyer and also leaves a balance to absorb debit notes. Prima solves the debit note pain.

Since the Prima platform is driven by supplier data, it can be implemented enterprise-wide, going live without an initial IT project and regardless of the number of ERPs, procurement processes and subsidiaries that the large corporate buyer might operate - Prima solves the ERP fragmentation pain.

Prima knows who owns the invoice and can generate the invoice payment accordingly. Prima also has interfaces into payment systems (CHAPS, ACH, etc) and can, optionally, generate payment instructions for invoice payments directly - Prima solves the un-financed invoice pain.

Automate supply chain finance

Prima’s platform is surprisingly simple to understand and it is based on a simple idea:

Ultimately, the problem for finance teams is that their environment (the one or many “ERPs") does not have the data needed in order to drive early approval decisions and manage related risks and processes. So manual interventions are required.

But the supplier does have all that data and Prima collects that data from suppliers simply and efficiently with minimal effort from the large corporate buyer. Data at scale arrives from suppliers as they ship and then Prima uses it intelligently to automate supply chain finance and enable large corporate buyers to manage the risks of early approvals much more effectively.

What next?

Just ask for a demo – seeing is believing. Click here to book a demo directly.

Solve the internal pain points that are stopping your SCF and dynamic discounting programs from scaling up to enterprise level – and give more of your suppliers access to accelerated payments.

Use Prima to automate supply chain finance. How hard can it be?